Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Discover how the Envestnet CRM and MoneyGuidePro integration eliminates data silos, saves time, and enhances client service. Streamline your workflow today

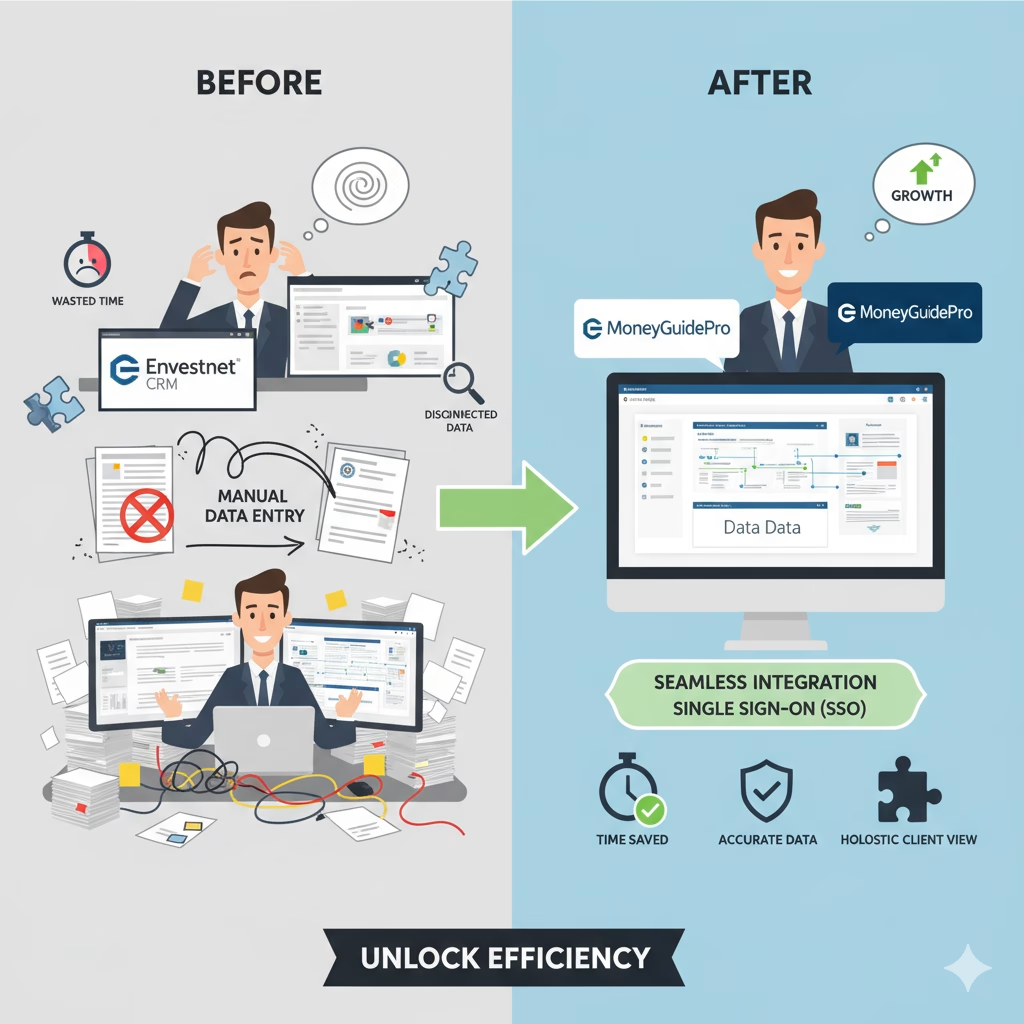

Are you tired of jumping between different apps? It’s a huge waste of time. You copy info here. You paste it there. This busy work hurts your client relationships. Think of your CRM as your most important sales tool. It builds trust. But you need it to work with your other software.

This guide is about the Envestnet CRM and MoneyGuidePro integration. It’s a solution that gives you back your time. It lets you focus on what matters your clients.

Envestnet CRM (formerly known as Tamarac CRM) is a client relationship management platform designed specifically for financial advisors, wealth managers, and investment firms.

Unlike general-purpose CRMs (like HubSpot or Zoho), Envestnet CRM is built for the wealth management industry, focusing on client data, household structures, financial reporting, and compliance needs.

Here are the main tools & functionalities Envestnet CRM offers:

Envestnet CRM helps financial advisors deepen client relationships, stay compliant, and scale their practices with automation and integrations.

MoneyGuidePro (often written MGP) is a goal-based financial planning software made by PIEtech. It was acquired by Envestnet in 2019. Crunchbase+2INSART+2

Its core purpose is helping financial advisors build interactive, client-centered financial plans. That means rather than just static numbers, it lets clients explore different life-goals, risks, what-ifs, and see how changes in assumptions affect outcomes. moneyguidepro.com+2Peak Financial Network Solutions+2

Here are the main tools & functionalities MoneyGuidePro offers:

| Feature | What It Does / Why It Matters |

| Goal-Based Planning | Clients can set multiple goals (e.g., retirement, college, travel, buying house) and the software helps project whether and how they can reach them, in what order, etc. |

| What-If Scenarios | Change assumptions (rate of return, retirement age, savings, expenses) to see how outcomes shift helps clients understand trade-offs. |

| Monte Carlo Simulations & Stress Testing | Runs simulations to model uncertain events (market drops, longevity, inflation) so clients/advisors can see risk, worst-case, probabilities. |

| Interactive Client Portals | Clients can view, change inputs, run through “Play Zone” (some scenarios) themselves, collaborate with the advisor. Peak Financial Network Solutions+2firstheritagecrest.com+2 |

| Customized Reports & Visuals | Graphs, projections, visual dashboards to show how goals are doing, where there are gaps, etc. Makes the conversation more tangible. firstheritagecrest.com+1 |

| Estate, Insurance, College, Retirement Tools | Supports different kinds of planning: college costs, insurance needs, longevity, etc. moneyguidepro.com+2Peak Financial Network Solutions+2 |

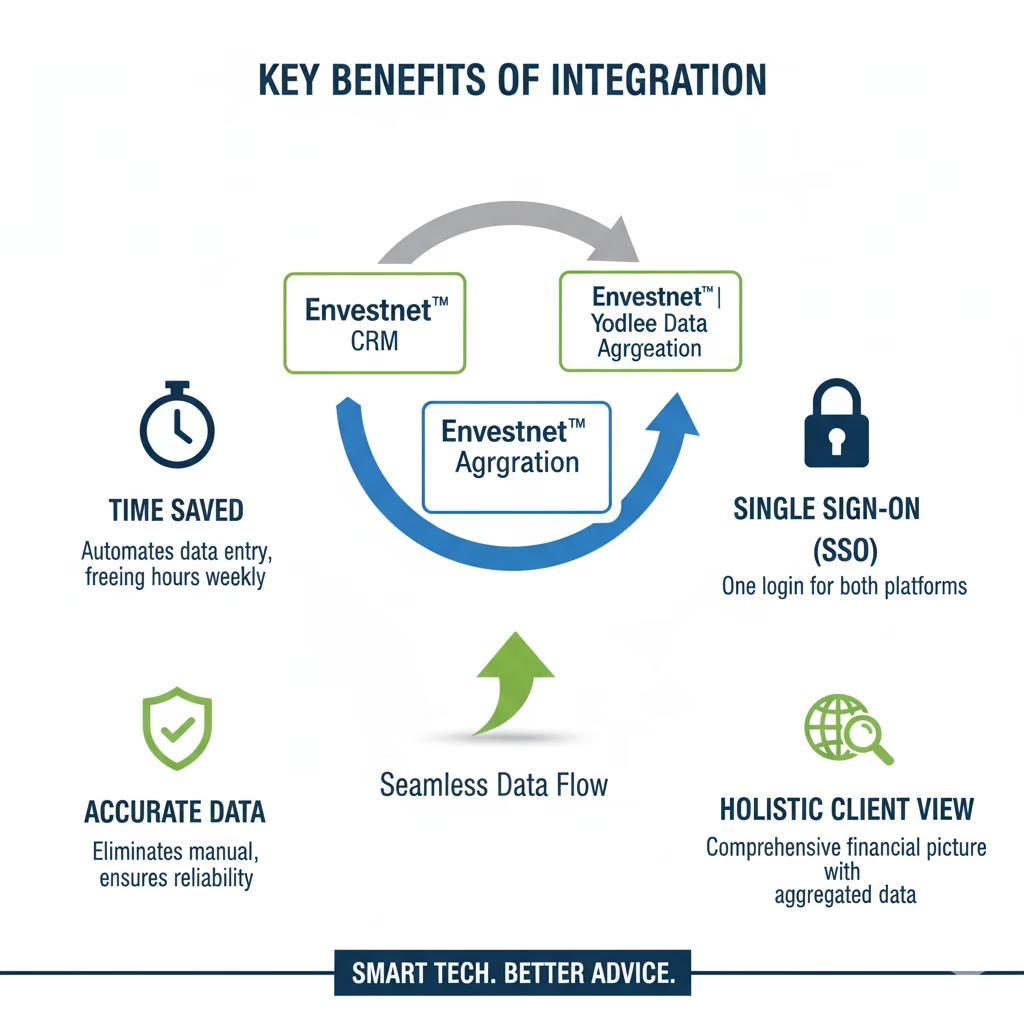

The Envestnet CRM and MoneyGuidePro integration connects your client data hub with your financial planning software. This link stops you from entering data twice. It creates a single, accurate source of client information. This makes your whole workflow much faster and more reliable.

Think of it like this. Your Envestnet CRM is your main office. It holds all your client information. MoneyGuidePro is your workshop. It’s where you build financial plans. Before, you had to run back and forth. You carried client files between the two rooms.

Now, this integration builds a direct hallway. Data flows freely and instantly. This simple connection is a true game-changer. It helps your wealth management platform operate smoothly.

This integration solves major problems for advisors. It stops duplicate data entry. It cuts down on human errors. It also saves hours of administrative time. This gives you more time to help your clients and grow your business.

Let’s break down the daily headaches it fixes.

Michael Kitces, a financial planning expert, notes the importance of efficiency. He stated, “The advisor who is more efficient can serve more clients, or serve their existing clients better and deeper.” This integration is a direct path to that efficiency.

Using Envestnet and MoneyGuidePro together is simple. You start in your Envestnet CRM dashboard. With one click, you can launch MoneyGuidePro. This is called Single Sign-On (SSO). Client data automatically syncs, creating a ready-to-use planning template.

The process is designed to be easy. You don’t need a technical degree.

This streamlined workflow automation turns a 30-minute task into a 2-minute one. It’s a core benefit of having a connected financial advisor tech stack.

This integration creates a superior workflow for retirement solutions. It ensures that the data in your envestnet retirement solutions platform is perfectly mirrored in your financial plans. This accuracy is critical for building trustworthy, long-term retirement strategies for clients.

Retirement planning needs to be precise. You are mapping out someone’s future. There is no room for error. When your systems are separate, you risk using old data. A client’s portfolio value might have changed. With integration, the CRM provides real-time data to MoneyGuidePro. You can model different scenarios with confidence. You know the underlying information is correct. This builds trust, which is the foundation of your business.

As one advisor on a Reddit forum mentioned, “Before we integrated, we were constantly double-checking account values. Now, it’s automatic. I can’t imagine going back. It’s night and day for our planning process.”

Many envestnet competitors exist, like Orion Advisor Solutions and Black Diamond. They often integrate with planning software like eMoney Advisor. However, the deep integration within the Envestnet ecosystem (Tamarac, Yodlee) offers a uniquely seamless experience that is hard to match.

Choosing the right RIA software is a big decision. While competitors offer great products, the key is the quality of the integration.

Before choosing, think about your main goal. If your goal is maximum workflow automation, a tightly integrated system like Envestnet and MoneyGuidePro is a top contender. Finding the right CRM software is the first step.

This tech stack is perfect for Registered Investment Advisor (RIA) firms and wealth management teams. If you want to scale your business and offer deep financial planning, this integration is a powerful asset. It helps you become more efficient and serve clients better.

Ask yourself these questions:

If you answered “yes” to any of these, you should explore this integration. It solves these specific pain points directly.

Stop letting manual tasks control your day. Your job is to provide expert advice, not to be a data entry clerk. The integration between Envestnet CRM and MoneyGuidePro is more than a feature. It’s a business strategy. It streamlines your operations. It ensures your data is accurate. Most importantly, it frees you up to build the relationships that grow your firm. You empower yourself to deliver better results for your clients.

Ready to build a more efficient practice?

1. How does Envestnet MoneyGuidePro Single Sign-On (SSO) work?

SSO allows you to access MoneyGuidePro directly from your Envestnet CRM dashboard. You don’t need a separate username or password for MoneyGuidePro. This feature saves time and simplifies your daily login process, getting you to work faster.

2. What specific client data syncs from Envestnet CRM to MoneyGuidePro?

The integration syncs crucial client information. This includes household details, contact information, and financial account data. Balances and holdings from accounts managed within Envestnet are automatically populated into the financial plan, ensuring accuracy.

3. Is Envestnet | Yodlee involved in the integration?

Yes, Envestnet | Yodlee plays a key role. It provides the account aggregation technology. This means it can pull in data from accounts held outside of Envestnet (like 401(k)s or bank accounts). This creates a complete financial picture for more holistic planning.

4. Can this integration help a solo financial advisor?

Absolutely. While it’s great for large firms, solo advisors benefit immensely. It provides powerful automation that acts like a virtual assistant. This allows a single advisor to operate with the efficiency of a larger team, saving valuable time and reducing overhead.

5. What is the main difference between Envestnet and Orion?

Envestnet and Orion are both leading wealth management platforms. A key difference is their ecosystem approach. Envestnet owns many of its components, like Tamarac CRM and Yodlee. Orion is known for its flexibility and open-architecture approach, integrating with many third-party apps.

6. How much time can I save with this workflow automation?

Advisors report saving anywhere from 20 to 60 minutes per financial plan. For a firm creating multiple plans each week, this adds up to hundreds of saved hours per year. This time can be reinvested into revenue-generating activities.

7. Does MoneyGuidePro work with other CRMs besides Envestnet?

Yes, MoneyGuidePro integrates with a wide range of popular CRMs used by financial advisors. However, the depth and seamless nature of the integration can vary between different CRM partners. The connection with Envestnet Tamarac is known to be particularly robust.

Author Bio: Written by the Best Sales Tool Team, experts in optimizing sales processes and maximizing business growth. We’re dedicated to helping you discover the most effective tools and strategies to achieve your sales goals.